The Effect of Government Relief and Post Disaster Settlement in Flood Zones

NOTE: This is work in progress. This entry can be cited as:

Raschky, Paul (2017). The Effect of Government Relief and Post Disaster Settlement in Flood Zones. Datainspace.org. Retrieved from: https://datainspace.org/index.php/2017/03/17/government-relief-and-settlement-in-flood-zones/

I. Introduction

Natural disasters can broadly be defined as a function of the natural hazard (the occurrence and magnitude of a potentially damage causing natural phenomena, such as a flood), the exposure (the elements at risk, such as the amount of people and capital in an affected area), as well as the vulnerability of the elements at risk (the degree of loss given a specific intensity of the hazard).

So far, the focus of the public and academic discussions has mainly been on the first parameter, the status quo and the potential increase in frequency and magnitude of natural hazards as a result of climate change (e.g. Mallakpour and Villarini 2015). In recent years, society’s vulnerability against natural hazards has received also some attention from economic scholars. Interestingly, however, economic research on factors that influence human settlement decisions into areas that are potentially subject to natural disasters is rather limited.

At a global level, we witness an increasing concentration of population and assets in areas that are exposed to the risk of flooding and other climatic hazards (e.g. Hallegatte et al. 2013).

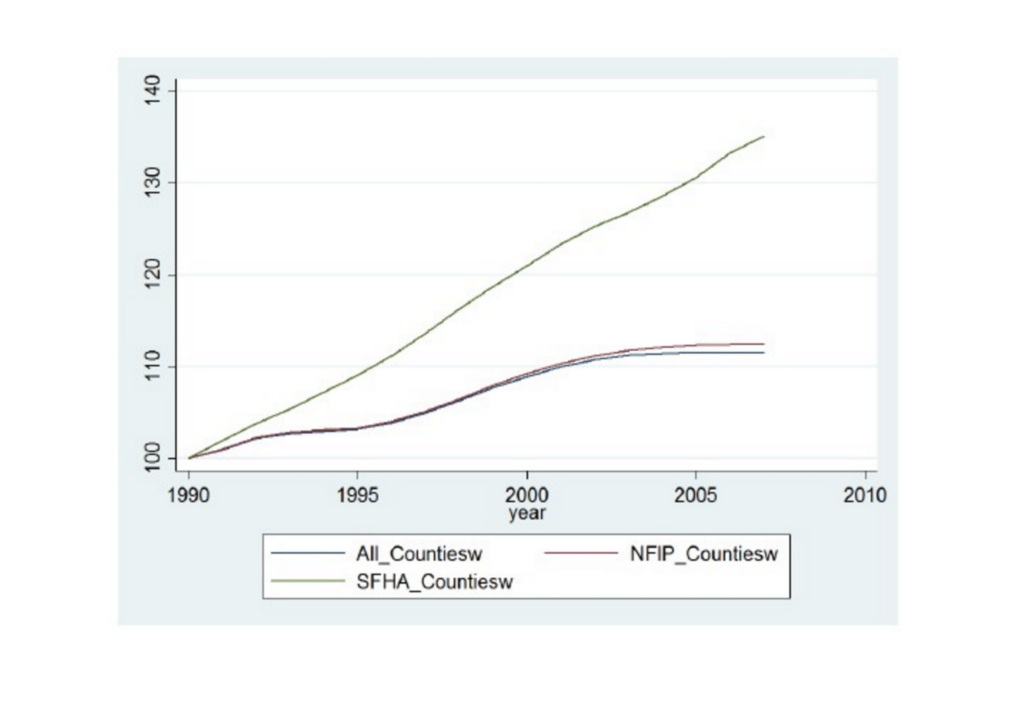

In the U.S., we observe a similar development. Figure 1 shows the weighted.[i] average population growth in all U.S. mainland counties for the years 1990 to 2007. The blue line indicates the population development in all counties, where the total population grew by 11.5\% over the period 1992 to 2007. In comparison, the population growth in counties where at least one community participates in the National Flood Insurance Program (NFIP) (red line), the population grew by around 12.5\%. Out of all the mainland counties in the sample around 80 \% have a least one NFIP community within their boundaries. Hence, this simply reflects that most settlements in the U.S. are located in coastal areas or near waterways where there can be a small risk of flooding. More strikingly, however, is that the population in counties with at least one community with a Special Flood Hazard Area (SFHA) (i.e. zones with a higher flood risk) increased by 35\% over the same period.

Figure 1. Weighted average population growth in all U.S. mainland counties, 1990-2007

Locating a home or a plant in a flood zone would not be problematic if all costs associated with that decision would be perfectly internalized. Unfortunately, this is not the case and the individual decision to settle in a flood risk area creates negative externalities on society. The costs of protecting human settlements against natural disasters as well as the costs of compensating those areas for the damages from actual disaster events are often spread to all members of society.

The purpose of this paper is to empirically analyze whether existing forms of government intervention associated with financial recovery from natural disasters, can increase this problem even further and create incentives for individuals to settle in flood risk area. In particular, I am going to examine the effect of U.S. federal flood relief spending and TV news reports about federal flood relief on settlement in flood zones within counties.

II. The Approach

I compile a balanced panel dataset for 2,681 U.S. mainland counties for the years 1990-2007. I use yearly information about nighttime light intensity at a 1km2 resolution to calculate for each county and year the fraction of economic activity located in flood zones. In a first step, I combine this data with information about local flood events, governmental flood relief, insurance penetration, protective measures and other socio-economic variables. This allows me to analyze the direct effect of receiving governmental relief on settlement decisions in an affected county.

In a second step, I extend the analysis to investigate the effect of observing the occurrence of governmental relief. In particular, I analyze the effect of TV news reports about governmental flood relief in the U.S on settlement in flood zones in counties unaffected by federal relief spending. For each year, I collect the number and duration of TV news reports on governmental flood relief[ii] from five major U.S. TV News stations.

III. Data

This section describes the source and construction of the main variables in the analysis. The unit of observation are U.S. mainland counties. The final dataset is a balanced panel with yearly observations for 2,681 counties over the period 1992-2007.

Nighttime Light Intensity in Flood Zones

The dependent variable is a proxy for the fraction of economic activity in a county that is located in a flood zone. To calculate this measure, I combine yearly data on nighttime light intensity with spatial boundaries of 1,048,575\footnote{The large number of individual flood hazards stems from the fact that multiple, individual geographical features (polygons) are actually all parts of one flood zone in a county but they are separated by geographical features (i.e. waterways).} flood hazard zones in the U.S and the spatial boundaries of U.S. counties.

The raw data on nighttime light intensity stems from the National Oceanic and Atmospheric Administration (NOAA) (http://ngdc.noaa.gov/eog/dmsp.html.) which provides annualized values for the years from 1992 to 2013. These data are based on recordings by US Air Force Weather Satellites in evening hours during the dark half of the lunar cycle in seasons when the sun sets early. NOAA removes observations affected by cloud coverage or northern or southern lights, and processes the data by setting readings that are likely to reflect fires, other ephemeral lights, or background noise to zero. The objective is that the reported nighttime light is primarily man-made. NOAA provides the annual data on a scale from 0 to 63 for output pixels that correspond to less than one square kilometer.

Using geographical information system (GIS) software, I then calculate for each of the 1,048,575 individual flood hazard zones the total nighttime light intensity. FEMA basically distinguishes between three groups of flood zones: Special Flood Hazard Areas (SFHA) are defined as the area that will be inundated by the flood event having a 1-percent chance of being equalled or exceeded in any given year. The 1-percent annual chance flood is also referred to as the base flood or 100-year flood.[iii] Moderate flood hazard and minimal flood hazard areas Low Flood Risk, (Areas labelled Zone B, C or X) are also shown on the FIRM, and are the areas between the limits of the base flood and the 0.2-percent-annual-chance (or 500-year) flood and zones that are higher than the elevation of the 0.2-percent-annual-chance flood, respectively. The third group, labelled by FEMA as Flood zone D, are Uncertain Flood Zones, where there are possible but undetermined flood hazards, as no analysis of flood hazards has been conducted.

In a next step I calculate the sum of nighttime light intensity, for each of the three groups of flood zones in a county, the total sum of nighttime light intensity in any flood zone in a county, as well as the total nighttime light intensity in the entire area of the county. I then divide the sum of nighttime light in each of the flood zone groups by the total nighttime light intensity in the county to generate the dependent variables. The main dependent variable is the fraction of nighttime light in any flood zone in a county.

The main advantage of nighttime light intensity over other indicators is its high degree of geographical fineness. It measures human, light emitting activity, on an area of less than 1 km$^2$. This enables one to observe changes in human economic activity at almost any geographical unit. More importantly, it also allows one to aggregate that activity at any geographical unit.

Henderson et al. (2012) advocate the use of nighttime light intensity as a measure of economic activity or economic development.[iv]They document a relatively strong association between nighttime light intensity and GDP at the country level, and Hodler and Raschky (2014a) provide evidence for a similarly strong association at the level of subnational administrative regions. Given its availability at the local level and its positive association with GDP, nighttime light intensity has become a widely used measure of economic activity or economic development in studies looking at subnational administrative regions (e.g., Hodler and Raschky 2014a,b) as well as ethnographic regions (e.g., Michalopoulos and Papaioannou 2013, 2014, Alesina et al. 2016, De Luca et al. 2016).

Governmental Flood Relief

The key explanatory variable, $Relief$, is a dummy variable that switches to one if the county received some governmental flood relief and zero otherwise. The data stems from FEMA’s public assistance database and I am using data from individual assistance (IA) program funds for housing assistance and other needs assistance. The former covers temporary housing or home repairs, and the latter covers damage to personal property, medical or funeral expenses from a disaster, and other costs not related to housing. These are grants to individuals that do not need to be repaid and are not counted as income on tax returns, and they are capped $31,900. The average grant, however, is around $4,000.

I refrain from using the total amount of relief money and only look at the effect on the extensive margin. The reason for this is the identification strategy. The IV approach exploits exogenous political variation (the interaction between election years and political importance of a county) that influences governmental relief. The process of governmental flood relief in the U.S. basically consist of two parts. The first part, is a discretionary part where the president first decides whether a flood event is large enough to be declared as an official disaster and which areas (states and counties) fall under this Presidential Disaster Declaration (PDD). This PDD is a prerequisite that victims of a flood event can claim public assistance. The second part, deals with the actual amount of public assistance (i.e. how much IA each claim will actually receive). This process follows a set of formal rules. As such, the IV can only explain variation in the first part of the process, which describes the extensive margin and not the second part which describes the intensive margin.

Flood Events

Data on flood events comes from the Spatial Hazard Events and Losses Database for the United States (SHELDUS) (http://hvri.geog.sc.edu/SHELDUS/) which provides data on natural hazard events for 18 different types of natural hazards. The database includes events that caused either a minimum of \$ 50,000 in damage or one fatality. One caveat of the SHELDUS database is that its coverage for flood is actually rather incomplete because it relies on self-reporting from a number of government agencies. Therefore, I augment this data with information from the Dartmouth Flood Observatory\footnote{http://www.dartmouth.edu/~floods/} as well as EM DAT\footnote{http://www.emdat.be/database}.

Although, the datasets contain monetary values for damages from most events, I only use the data to construct a dummy variable, $Flood$, that switches to one if a county experienced at least one flood event in a given year, and zero otherwise. The reason for this is that the damage data are often “guesstimates” (at best), which would result in additional measurement error problems. Considering that the relief variable is also just a dichotomous variable, this choice seems to be reasonable.

News

To analyze the effect of news reports of governmental relief on location decisions, I accessed Vanderbilt TV News Archive. This is an electronic archive of all media reports broadcasted by the 4 major U.S. TV stations ABC, CBS, NBC, CNN. It archives each news report and provides information about the title of the report, date duration as well as a short abstract. Using a keyword search, I downloaded all news reports that contained the terms related to federal relief and floods. For each year I build two variables: The natural log of the sum of news reports that mention flood relief and the natural log of the total duration of all news reports (in minutes) on flood relief.[v] This is likely to result in a measurement error and a downward bias in the estimated coefficient.

IV. Preliminary Results

Overall, directly receiving federal flood relief has a very small, statistically significant and negative effect on nighttime light intensity in flood zones. However, the effect differs by type of flood zones. Whereby past relief payments decrease settlement in SFHA and low risk zones, it slightly increases nighttime light intensity in zones where flooding is possible but not yet determined (Flood Zone “D”) . Those results suggest that the charity hazard aspect of federal relief is not an issue with respect to location decisions after flooding. First, individual relief grants are actually quite small (on average around $ 5,000). As such, federal relief can be considered a “free insurance” with a very large excess. Second, federal flood relief comes with a number of conditions for homeowners and local governments. Homeowners who have not been previously insured will often be obliged to purchase flood insurance under the NFIP. This effectively puts a price tag on the homeowner’s previous location decision and makes it more costly to live in a flood zone.

However, areas that are potentially subject to flooding but where the risk has not been determined yet by FEMA, might provide some discretionary decision making by homeowners and local government. For example, in those flood zones flood insurance is not federally required by lenders for property loans. For local developers and policy makers, the more certain benefits from short-term development might outweigh the more uncertain costs of a long-term increase in damage potential.

Increased media attention of federal relief increases settlement in flood zones in counties that have not been subject to actual relief payments. Again, however, the effect is relatively small in magnitude. This suggests that the “charity hazard” (Raschky and Weck–Hannemann 2007) effect of federal relief is largely a result of potentially wrong expectations about the extent of flood relief.

ENDNOTES

[i] The weight is constructed from the county’s base population in 1990.

[ii] This is restricted to reports on U.S. federal flood relief.

[iii] Within this group there are zones labelled as Zone A, Zone AO, Zone AH, Zones A1-A30, Zone AE, Zone A99, Zone AR, Zone AR/AE, Zone AR/AO, Zone AR/A1-A30, Zone AR/A, Zone V, Zone VE, and Zones V1-V30.

[iv] Earlier studies using nighttime light intensity as a proxy for economic activity include Sutton and Constanza (2002), Doll et al.\ (2006), and Sutton et al.\ (2007).

[v] At this stage, I was not able to fully filter out news reports on flood relief happening overseas.

REFERENCES:

Alesina, Alberto, Stelios Michalopoulos, and Elias Papaioannou, “Ethnic Inequality,” Journal of Political Economy, 124 (2016), 428-488.

Botzen, Wouter J., and Jeroen van den Bergh, “Risk Attitudes to Low-Probability Climate Change Risks: WTP for Flood Insurance,” Journal of Economic Behavior and Organization, 82 (1) (2012) 151–166.

Buchanan, James. “The Samaritan’s Dilemma.” In Altruism, Morality, and Economic Theory, ed. E. Phelps, 71–85. (1975), New York: Russell Sage Foundation.

Coate, Stephen, “Altruism, the Samaritan’s Dilemma, and Government Transfer Policy,”

American Economic Review, 85 (1) (1995), 46–57.

Costanza, Robert and Paul C., Sutton, “Global Estimates of Market and Non-Market Values Derived from Nighttime Satellite Imagery, Land Use, and Ecosystem Service Valuation,” Ecological Economics, 41 (2002), 509-527.

Doll, Christopher N.H., Jan-Peter Muller, and Jeremy G. Morley, “Mapping Regional Economic Activity from Night-Time Light Satellite Imagery,” Ecological Economics, 57 (2006), 75-92.

De Luca, Giacomo, Roland Hodler, Paul A. Raschky and Michele Valsecchi, “Ethnic Favoritism: An Axiom of Politics?”, CEPR Discussion Paper 11351 (2016).

Ehrlich, Isaac, and Gary S. Becker,“Market Insurance, Self-Insurance, and Self-Protection,” Journal of Political Economy, 80 (4) (1972), 623–648.

Gallagher, Justin, “Learning about an Infrequent Event: Evidence from Flood Insurance Take-Up in the United States,” American Economic Journal: Applied Economics, 6 (3) (2014), 206-233.

Garrett, Thomas A., and Russell S. Sobel, “The Political Economy of FEMA Disaster Payments.” Economic Inquiry, 41 (3) (2003), 496–508.

Hallegatte, Stephane, Colin Green, Robert J. Nicholls and Jan Corfee-Morlot “Future Flood Losses in Major Coastal Cities,” Nature Climate Change 3 (2013), 802–806.

Henderson, Vernon J., Adam Storeygard, and David N.~Weil, “Measuring Economic Growth from Outer Space,” American Economic Review, 102 (2012), 994-1028.

Herring, Bradley. “The Effect of the Availability of Charity Care to the Uninsured on the Demand for Private Health Insurance,” Journal of Health Economics 24 (2) (2005), 225–252.

Homburg, Stefan. “Compulsory Savings in the Welfare State,” Journal of Public Economics 77 (2) (2000), 233–239.

Hodler, Roland, and Paul A.~Raschky, “Regional Favoritism,” Quarterly Journal of Economics, 129 (2014a), 995-1033.

Hodler, Roland, and Paul A.~Raschky, “Economic Shocks and Civil Conflict at the Regional Level,” Economics Letters, 124 (2014b), 530-533.

Kocornik-Mina, Adriana Thomas McDermott, Guy Michaels and Ferdinand Rauch, “Flooded Cities,” Department of Economics Discussion Paper Number 772, University of Oxford, (2015).

Kousky, Carolyn, Erwann O. Michel-Kerjan and Paul A. Raschky, “Does Federal Assistance Crowd Out Private Demand for Insurance?” Working Paper 2014-04, The Wharton Risk Management and Decision Process Center (2014).

Lewis, Tracy, and David Nickerson, “Self-Insurance against Natural Disasters,” \emph{Journal

of Environmental Economics and Management} 16 (3) (1989), 209–223.

Mallakpour, Iman and Gabriele Villarini, “The Changing Nature of Flooding Across the Central United States,” Nature Climate Change 5 (2015), 250-254.

Michalopoulos, Stelios, and Elias Papaioannou, “Pre-Colonial Ethnic Institutions and Contemporary African Development,” Econometrica, 81 (2013), 113-152.

Michalopoulos, Stelios, and Elias Papaioannou, “National Institutions and Subnational Development in Africa,” Quarterly Journal of Economics, 129 (2014), 151-213.

Petrolia, Daniel R., Craig E. Landry, and Keith H. Coble, “Risk Preferences, Risk Perceptions, and Flood Insurance,” Land Economics 89 (2) (2013), 227–245.

Raschky, Paul A., Reimund Schwarze, Manijeh Schwindt, and Ferdinand Zahn, “Uncertainty of Governmental Relief and the Crowding out of Flood Insurance,” Environmental and Resource Economics 54 (2) (2013), 179–200.

Raschky, Paul A. and Manijeh Schwindt “Aid, Catastrophes and the Samaritan’s Dilemma,” Economica forthcoming (2016).

Raschky, Paul A., and Hannelore Weck-Hannemann, “Charity Hazard -— A Real Hazard to Natural Disaster Insurance?” Environmental Hazards 7 (4) (2007), 321–329.

Strobl, Eric, “The Economic Growth Impact of Hurricanes: Evidence from U.S. coastal

Counties,” Review of Economics and Statistics, 93(2) (2011), 575-589.

Sutton, Paul C., Christopher D. Elvidge, and Tilottama Ghosh, “Estimation of Gross Domestic Product at Sub-National Scales Using Nighttime Satellite Imagery,” International Journal of Ecological Economics & Statistics, 8 (2007), 5-21.